40 what is bond coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

› terms › sStep-Up Bond Definition - Investopedia Oct 21, 2020 · Step-Up Bond: A step-up bond is a bond that pays an initial coupon rate for the first period, and then a higher coupon rate for the following periods. These bonds are often purchased by ...

What is bond coupon rate

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)? Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

What is bond coupon rate. What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. What Is Coupon Rate of a Bond - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Consider a bank bond with a coupon rate of 7.6% and | Chegg.com The par value is $2850, and the bond has 12 years to mature. The yield to maturity is 9.2%. What is the value of the bond? Question: Consider a bank bond with a coupon rate of 7.6% and coupons paid annually. The par value is $2850, and the bond has 12 years to mature. The yield to maturity is 9.2%. What is the value of the bond? en.macromicro.me › collections › 51Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond ... Save US 10-year T-Note Auction Coupon Rate. The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in bond price. When coupon rate remains high, bond price falls. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

What is a Coupon Rate? - Definition | Meaning | Example For example, the rate of a government bond is usually paid once a year, but if it is a U.S. bond the payment is made twice a year. Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... What Is a Coupon Rate? And How Does It Affects the Price of a Bond? A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer of zero-coupon bonds only pays the face value of bonds at the maturity date. Instead of paying coupon interest, the bond issuer issues the bonds at price less than the face value. The discount of issue effectively represents the interest and yield for investors ... Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What is a Bond Coupon Rate? - Financial Expert™ What is a bond coupon rate? The coupon rate of a bond is the rate of interest that a borrower will pay on the original amount they borrowed. The coupon rate is usually stated in the name of the bond. To illustrate this: GLAXOSMITHKLINE CAPITAL PLC 5.25% NT REDEEM has a coupon rate of 5.25%. Said another way, the coupon rate is the relationship ...

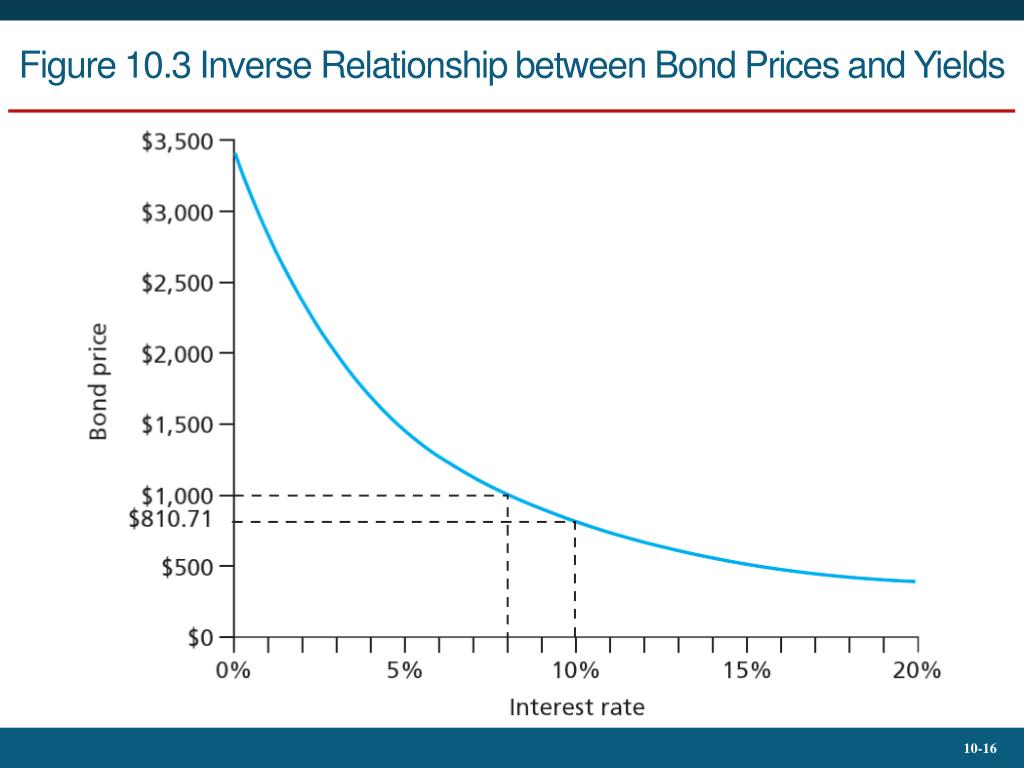

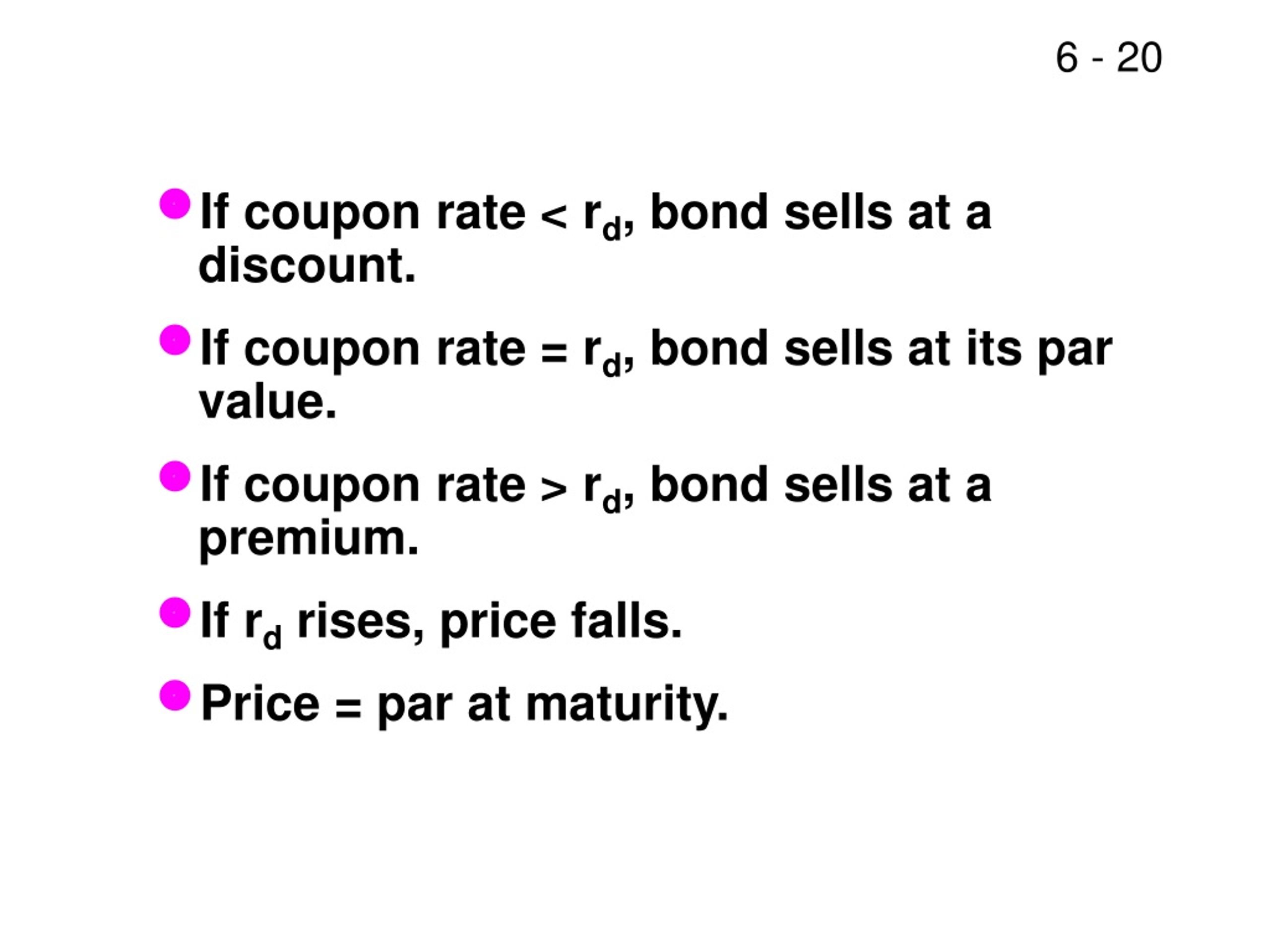

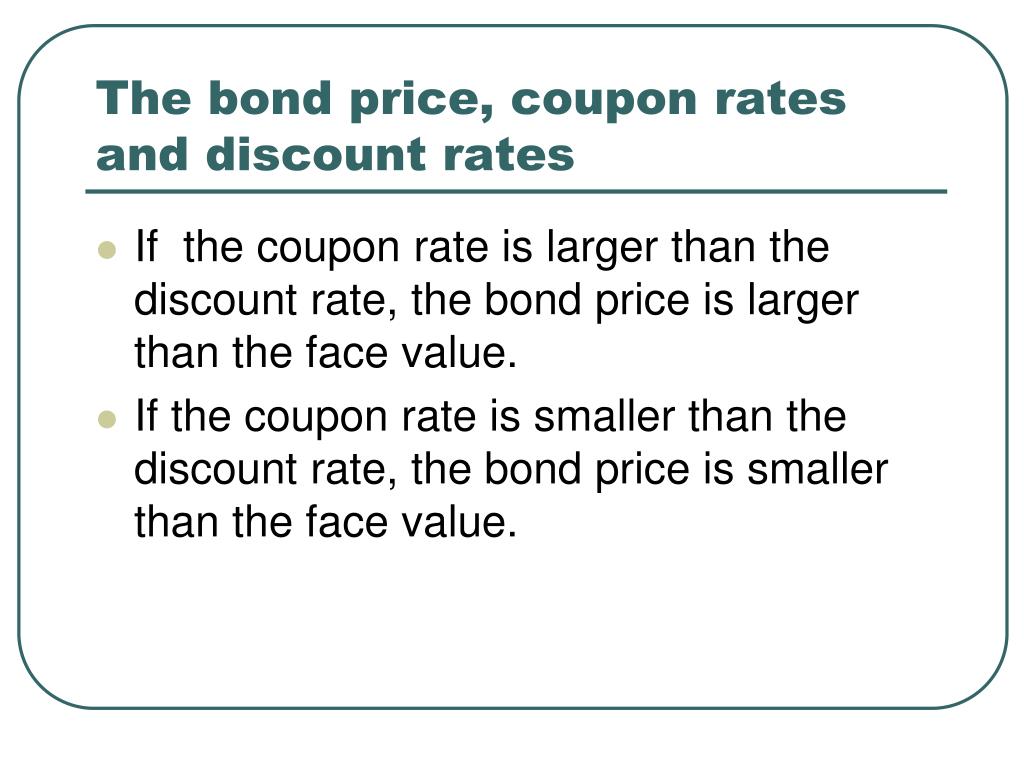

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually; Bond price is 963.7; Based on the above information, here are all the components needed in order to calculate the Macaulay Duration: m = Number of payments per period = 2; YTM = Yield to Maturity = 8% or 0.08; PV = Bond price = 963.7; FV = Bond face value = 1000; C ...

How To Determine Coupon Rate On A Bond - khaodara.info Just picked up 6 packs 2 per pack of Hubbelite XPR bulbs 3. That is pretty how to determine coupon rate on a bond impossible in a restaurant that is open so many hours. not the easiest solution! The products we sell are sourced from a variety of international suppliers with China as a significant source. More Big savings for you with NTB best ...

How Do You Discount Bonds? - Dr Reads The bond discount rate is, therefore, $41.31/$1,000 = 4.13%. Which is better discount bond or premium bond? So, a premium bond has a coupon rate higher than the prevailing interest rate for that particular bond maturity and credit quality.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Post a Comment for "40 what is bond coupon rate"