43 coupon vs zero coupon bonds

What is the difference between a zero-coupon bond and a regular ... - Quora Simple, zero coupon bonds are sold at significantly lower prices or at deep discounts- say a bond with a face value of $1000 will sell for lower than its face value say $750. So at maturity while the investor would not receive any interest, he will receive the full face value of the bond. Profit=$1000-$750=$250 (Numbers are meant purely Bond Economics: Primer: Par And Zero Coupon Yield Curves Primer: Par And Zero Coupon Yield Curves. Par and zero coupon curves are two common ways of specifying a yield curve. Par coupon yields are quite often encountered in economic analysis of bond yields, such as the Fed H.15 yield series. Zero coupon curves are a building block for interest rate pricers, but they are less commonly encountered away ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Coupon vs zero coupon bonds

Discount bond vs. Zero coupon bond : personalfinance - reddit They're all colloquialisms that change with time. But yea, hes wrong. Discount means trading at a discount (less than face value), zero coupon is exactly that, no coupons (like treasuries) A discount bond is just a bond that sells/trades at a discount to par value. Your economics professor is incorrect. Zero-Coupon Bond: Formula and Excel Calculator In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return How Does an Investor Make Money On Bonds? A zero-coupon bond is bought at a discount from its face value, and the investor receives the full face value when it matures. The interest paid on a bond may be pre-set or may be based on prevailing interest rates at the time it matures. For instance, if you invested $1,000 in a 10-year bond with a coupon rate of 4%, the issuer would send you ...

Coupon vs zero coupon bonds. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. What is the difference between a zero-coupon bond and a regular bond? The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not... Deep Discount bonds and Zero Coupon Bonds - The Fixed Income A cumulative product provides clarity of coupon paid. The taxation of the returns depends on the tax treatment prescribed at the time, varying from being taxed at maturity or on the accrued interest being taken up for tax in the year it is earned. Another avatar of the deep discount bond is the zero-coupon bond (ZCB).

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting A zero-coupon bond is one that is popular because of its ease. The face value of a zero-coupon bond is paid to the investor after a specified period of time but no other cash payment is made. There is no stated cash interest. Money is received when the bond is issued and money is paid at the end of the term but no other payments are ever made. Ashish Tayal on LinkedIn: Zero coupon bond vs Inflation indexed bond Zero coupon bond vs Inflation indexed bond... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The lower the coupon the longer the duration The zero coupon bond is ... This preview shows page 146 - 149 out of 162 pages. The lower the coupon, the longer the duration. The zero-coupon bond is the ultimate low coupon bond, and thus would have the longest duration. 35. When interest rates decline, the duration of a 10-year bond selling at a premium A. increases. B. decreases.

Zero-coupon bond - Bogleheads Zero-coupon bonds or "zeros" result from the separation of coupons from the body of a security. Consequently, from a single coupon-paying bond, two bonds result: one which pays the coupons but returns no principal at maturity (an annuity), and one which pays no coupons but returns the par value at maturity (a zero-coupon bond). Zeroes sell ... Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value Some issuers may call zeros before maturity You must pay tax on interest annually even though you don't receive it until maturity Zero coupon bonds are more volatile than regular bonds Difference Between a Zero-Coupon CD & a Bond | Budgeting Money - The Nest One of the main differences between zero-coupon CDs and a bonds is in the way you buy and sell them. Although some financial services firms now offer CDs, traditionally you buy a CD directly from the issuing bank. If you sell the CD back to the bank before it matures, you will owe an interest penalty. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

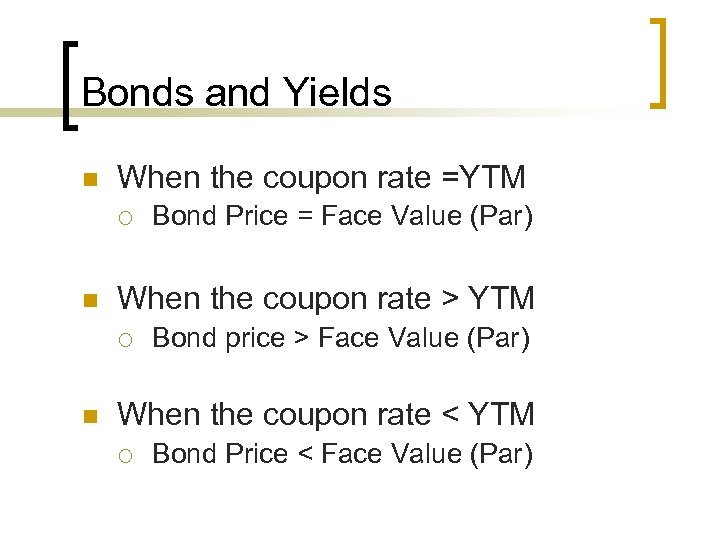

Zero Vs Fixed Coupon Bond volatility | QuantNet Community Everywhere I look for this on the internet I read that Zero Coupon Bonds are more volatile than Fixed Coupon Bonds. The explanation for this seems to be that the Duration (both Macaulay and Modified) are larger the lower the size of the coupon is, and consequently a, let's say 10Y ZC Bond has a larger duration than a 10Y 5% Coupon Bond.

Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially...

Numeraire: Money market vs zero coupon bond | QuantNet Community Q2: Normalized zero-coupon bond pays $1 at its maturity. Let P (t,T) denote the price of a ZC bond at time t that matures at time T. By a basic no-arbitrage argument, P (t,T) is related to the money market account via P (t, T) = E_t^Q [1/M (t,T)]. Q3: It is not that a fixed income instrument satisfies this SDE, it is simply that you could take ...

Special Zero Coupon Recapitalisation Bonds - Drishti IAS The difference between the purchase price of a zero coupon bond and the par value at the time of maturity, indicates the investor's return. The Zero Coupon bonds generally come with a time horizon of 10 to 15 years. Difference: Special Zero Coupon Bonds are being issued at par, there is no interest however Normal Zero Coupon Bonds are issued at ...

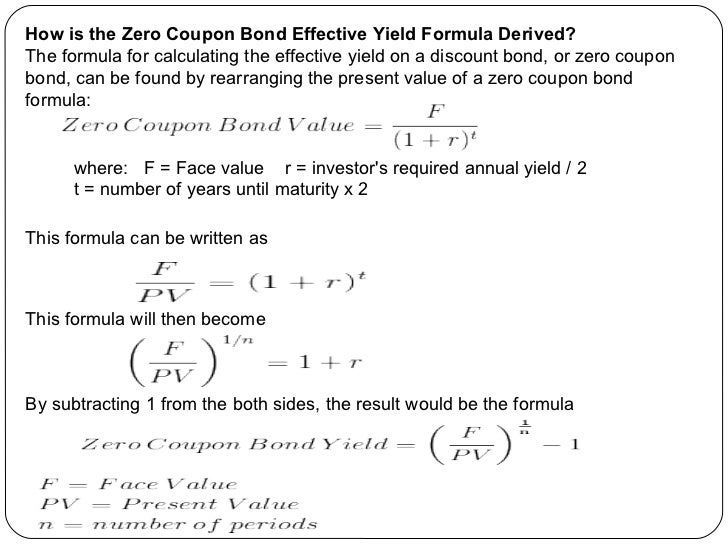

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A coupon is an interest the bond issuer pays the bondholder. Coupon payments happen periodically from the time of issuance of the bond until its maturity. A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor.Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Deep Discount Bonds Vs Zero Coupon Bonds : AsambleDiscount Get Deep Discount Bonds Vs Zero Coupon Bonds from this website and save money on your next purchase. They update the coupons regularly, so be sure to check back often for the latest deals.You may visit the link to get started and find the perfect coupon for you.

About Discount Bonds versus Zero Coupon Bonds Zero Coupon bonds generally have a Maturity Date that is more than a year and a half out from the issue date. Unlike discount bonds, Zero Coupons do take compounding into account, and are generally issued with a semi-annual compounding yield; therefore, they have a Payment Frequency equal to the standard payment frequency of semi-annual.

How Does an Investor Make Money On Bonds? A zero-coupon bond is bought at a discount from its face value, and the investor receives the full face value when it matures. The interest paid on a bond may be pre-set or may be based on prevailing interest rates at the time it matures. For instance, if you invested $1,000 in a 10-year bond with a coupon rate of 4%, the issuer would send you ...

Zero-Coupon Bond: Formula and Excel Calculator In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return

Discount bond vs. Zero coupon bond : personalfinance - reddit They're all colloquialisms that change with time. But yea, hes wrong. Discount means trading at a discount (less than face value), zero coupon is exactly that, no coupons (like treasuries) A discount bond is just a bond that sells/trades at a discount to par value. Your economics professor is incorrect.

Post a Comment for "43 coupon vs zero coupon bonds"