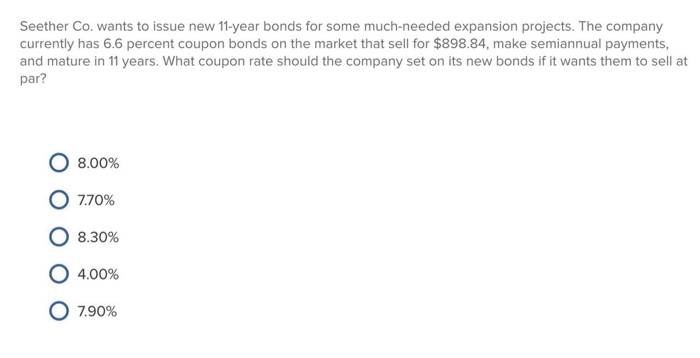

38 what coupon rate should the company set on its new bonds if it wants them to sell at par

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. Chamberlain Co. wants to issue new 20-year bonds for some - SolutionInn Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Solved Uliana Company wants to issue new 18-year bonds for - Chegg Uliana Company wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,045, have a par value of $1,000, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

What coupon rate should the company set on its new bonds if it wants them to sell at par

Ashok Co. wants to issue new 19-year bonds for some necessary expansion ... The coupon rate would be is = 6.8%. How to Financial calculator? For a bond to sell at par value, it means that the price is $1000 which is the same as the Face value, and also the YTM will be equal to the coupon rate. Then we are Using a financial calculator, then we input the following; After that, The Future value; FV is = 1000. Then Price ... Seether co wants to issue new 20 year bonds for some Seether Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? →8.75%. The company should set the ... E-book: Essentials of Corporate Finance Ross · 2016 · Business & EconomicsWhat coupon rate should the company set on its new bonds if it wants them to sell at par? 23. Accrued Interest. You purchase a bond with an invoice price of ...

What coupon rate should the company set on its new bonds if it wants them to sell at par. Solved Chamberlain Co. wants to issue new 20 -year bonds for | Chegg.com You must use the built-in Excel function to answer the bond nrice auestions. A Japanese company has a bond outstanding that sells for 91.53 percent of its ¥100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? Complete the following analysis. (Solved) - What coupon rate should the company set on its new bonds if ... 1 Answer to Bond Yields BDJ ... Bond Yields RAK Co. wants to issue new 20-year bonds for... ask 5 Bond Yields RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 5.7 percent coupon bonds on the market that sell for $1,048, have a par value of $1,000, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? FIN Flashcards | Quizlet The company currently has 8.8 percent coupon bonds on the market that sell for $950.85, make semiannual payments, and mature in 16 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1,000. ... Weismann Co. issued 19-year bonds a year ago at a coupon rate of 10 percent.

OneClass: Chamberlain Co. wants to issue new 20-year bonds for some ... Seether Co. wants to issue new 13-year bonds for some much-needed expansion projects. The company currently has 9.8 percent coupon bonds on the market that sell for $868.69, make semiannual payments, and mature in 13 years. What coupon rate should the company set on its new bonds if it wants them to sell at par Answered: 22. Bond Yields [LO2] Chamberlain Co.… | bartleby Transcribed Image Text: 22. Bond Yields [LO2] Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them ... Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer At 8% Vo = 96/2× [1- (1.04)^-42/0.04] + 1000 (1.04)^-42 … View the full answer Coupon Rate the Company Should Set on Its New Bonds - BrainMass 418233 Bond coupon rate and yield to maturity Not what you're looking for? Search our solutions OR ask your own Custom question. A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years.

RAK Co. wants to issue new 20-year bonds for some...get 1 The company currently has 6 percent coupon bonds on the market that sell for $1,055, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Quiz 6 PDF - 1.BDJ Co. wants to issue new 21-year bonds for... What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate 7 .8 2 ± 1 .0 % % Explanation: The company should set the coupon rate on its new bonds equal to the required return of the ... Airbutus Co. wants to issue new 20-year bonds for some much- needed ... Airbutus Co. wants to issue new 20-year bonds for some much- needed expansion projects. The company currently has 8% coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? MavRay is waiting for your help. Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Coupon payment = (1000 x 7.9%x50%) Coupon payment = 39.5 Number of periods = 13 x 2 Number of periods = 26 Periodic YTM = 5.6%/2 Periodic YTM = 2.8% Price = -PV (rate,nper,pmt,fv)) Price = -PV (2.8%,26,39.5,1000) Price = 1,210.40 You purchase a bond with an invoice price of $1,145.

Pembroke co wants to issue new 20 year bonds for some - Course Hero Round your answer to 2 decimal places. (e.g., 32.16)) Coupon rate 6.44 ± 1% % The company should set the coupon rate on its new bonds equal to the required return. The required return can be observed in the market by finding the YTM on outstanding bonds of the company.

Ebook: Fundamentals of Corporate Finance HILLIER · 2011 · Business & EconomicsWhat coupon rate should the company set on its new bonds if it wants them to sell at par? 20 Accrued Interest [LO2] You purchase a bond with an invoice ...

Finance Midterm 1 Flashcards | Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Answer in Finance for rim #9185 - assignmentexpert.com What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40

Coccia Co. wants to issue new 20-year bonds for some much-needed ... Bdj co. wants to issue new 19-year bonds for some much-needed expansion projects. the company currently has 8.8 percent coupon bonds on the market that sell for $1,128, make semiannual payments, have a $1,000 par value, and mature in 19 years. what coupon rate should the company set on its new bonds if it wants them to sell at par? See answers ( 1)

Post a Comment for "38 what coupon rate should the company set on its new bonds if it wants them to sell at par"