38 bond price zero coupon

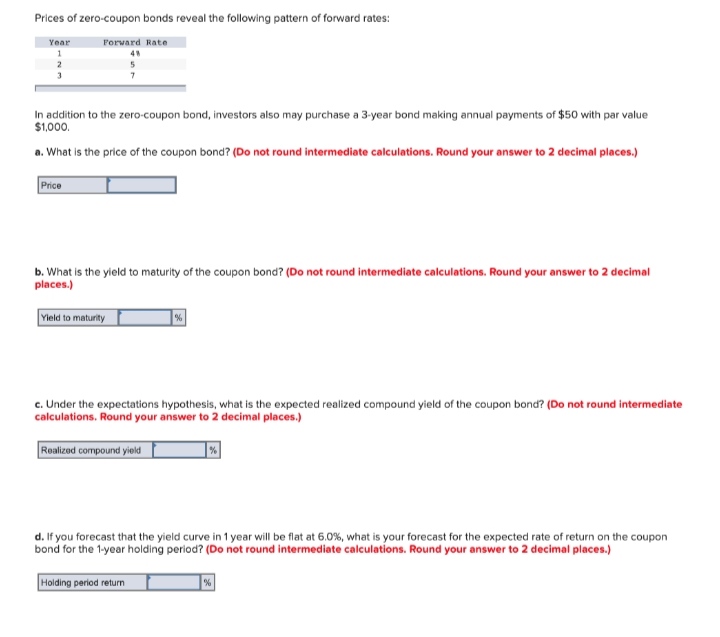

Indonesia Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Indonesia Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Price Day High 91.5938 Price Day Low 90.5312 Coupon 3.00% Maturity 2052-08-15 Latest On U.S. 30 Year Treasury INVESTING CLUB Bond yields rise, 2-year Treasury breaks 3.8% on higher Fed hike...

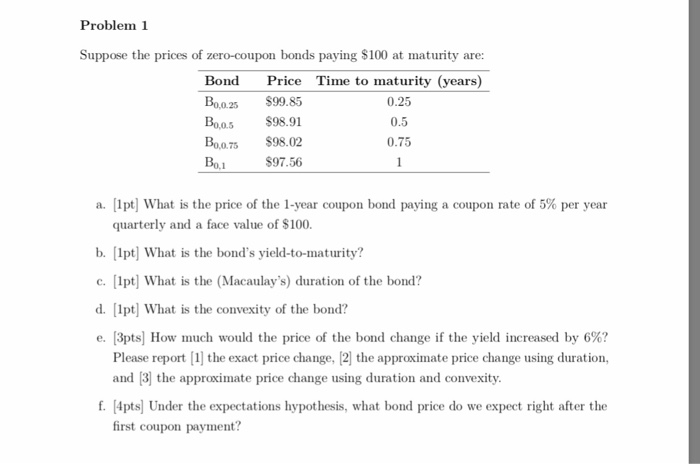

How to calculate yield to maturity in Excel (Free Excel Template) Here are the details of the bond: Par Value of Bond ( Face Value, fv ): $1000 Coupon Rate ( Annual ): 6% Coupons Per Year ( nper ): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years. From the time you buy the bond. Current Price of Bond ( Present Value, pv ): $938.40

Bond price zero coupon

How to Invest in Bonds - The Motley Fool With the Federal Reserve aggressively hiking interest rates in 2022, yields have gone up, which means that bond prices have generally gone down. Not all bonds pay interest. Some bonds, known as... United Kingdom Government Bonds - Yields Curve United Kingdom Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is an exchange of cash flows in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap, but where the stream of...

Bond price zero coupon. Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... Therefore, the price of a zero coupon bond can be calculated as: {eq}\text{Zero-Coupon Price} = \dfrac{\text{Par Value}}{(1+r)^{n}} {/eq} Newly issued bonds usually sell at par value. This happens ... What does a negative bond yield mean? - Investopedia To calculate, simply divide the annual coupon payment by the bond's selling price. For example, assume a $1,000 bond has a coupon rate of seven percent, which means that the bond pays $70 annually... How to Buy More than $10,000 in I Bonds Through This Loophole I Bonds Basics I Bonds are issued by the federal government and carry a zero-coupon interest rate - plus, they are adjusted each year for inflation. The variable return will sit at 9.62% through... Pakistan Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Pakistan Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund - BTTRX. Zero Coupon 2025 Fund. SUMMARY PERFORMANCE COMPOSITION MANAGEMENT. $105.64 | 0.33% ($0.35) NAV as of 09/02/2022. Historical NAV. Yield to Maturity: Compute price of zero coupon bonds - BrainMass The following table summarizes the yields to maturity on several one-year, zero-coupon securities: Security Yield (%) Treasury 3.15 AAA corporate 3.30 BBB corporate 4.30 B corporate 5.00 a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. Government Bonds - Meaning, Types, Advantages & Disadvantages - Scripbox Also, they are very similar to zero coupon bonds. However, they are created out of the existing securities. Sovereign Gold Bonds (SGBs) Sovereign Gold Bonds have their prices linked to the price of gold (commodity price). The nominal value of the bond is calculated based on the previous week's simple average closing price of 99.99% of purity ... South Africa Government Bonds - Yields Curve South Africa Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

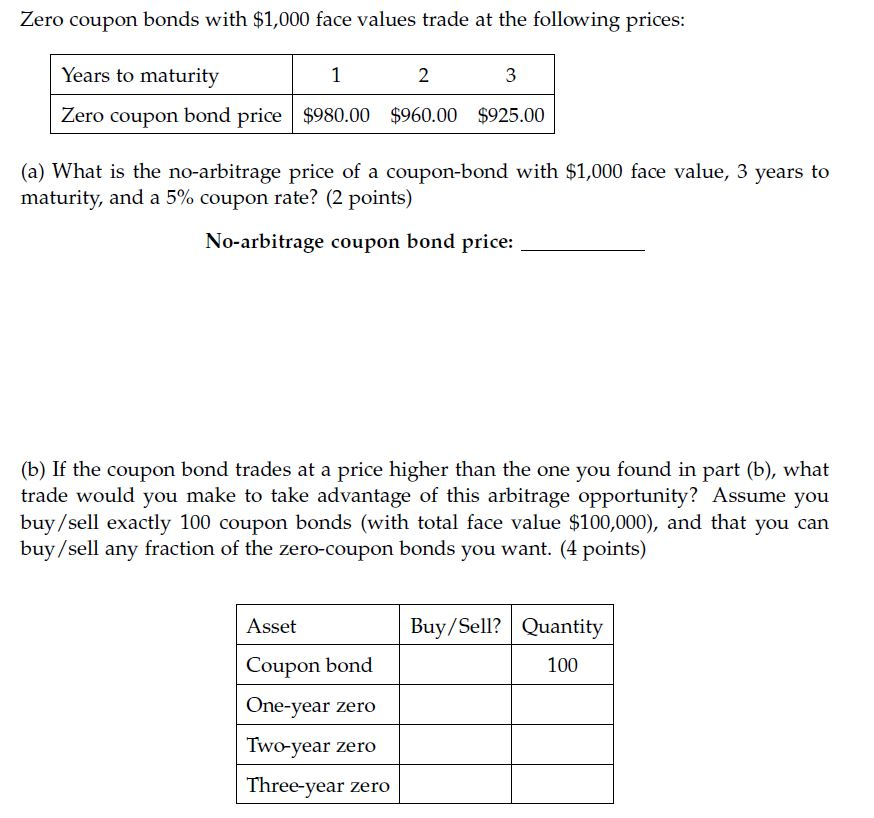

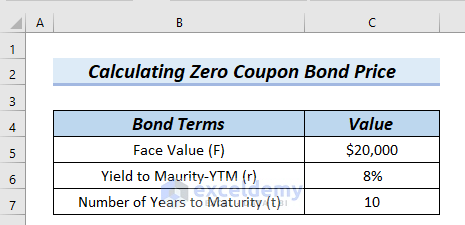

Investing in Bonds Online in India | HDFC Securities In return, the issuer promises to pay a specified rate of interest during the life of the bond. The issuer also repays the face value of the bond when upon maturity of the term. Learn about different types of bonds and find suggestions for best bonds to invest in! Bonds List; ... ZERO-COUPON BONDS These investment bonds are issued at a discount Canada Government Bonds - Yields Curve Canada Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Free Coupon Help - Blogger Storybook Land Coupons & Promo codes - CouponsPlusDeals.com Get Code, Great Offer, $14 Off Your Order, Applies for all selected products. Get Code, Great Offer, $20 Off Single Day Ticket, Get $20 Off Single Day Ticket. Get better discounts on your spending by using this code. Check it out now Post a Comment Read more 40 chase bank coupon offers What Is a Zero-Coupon Bond? - The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

EGP T-Bonds Treasury Auctions T-Bonds. EGP T-Bonds; EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. Fixed Rate Repo; Variable Rate Repo; FX Auction. ... Value (EGP mio) Issue Date Maturity Date Submission Deadline(11 A.M) T.Bonds: 7: 500: 13/09/2022: 05/07/2029: Monday, 12/09/2022: T ...

How to Invest in U.S. Saving Bonds - The Motley Fool Series E bonds were sold at 75% of face value and would pay face value at maturity, typically after 10 years. The bonds, known as "war bonds," were considered zero coupon bonds and paid no annual ...

Brazil Government Bonds - Yields Curve Brazil Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

EGP T-Bonds Zero Coupon EGP Treasury Zero Coupon Bonds Auctions According to the Primary Dealers System. Type Tenor (years) Value (EGP mio) Issue Date Maturity Date Submission Deadline(11 A.M) T.Bonds: 1.5: 7,000: 13/09/2022: 12/03/2024: Monday, 12/09/2022: Results. EGP Treasury Zero Coupon Bonds Auctions According to the Primary Dealers System.

Your Complete Guide to Corporate Bonds - The Motley Fool Zero-coupon bonds, which don't come with interest payments. Instead, you pay below face value (the amount the issuer promises to repay) and receive full value at maturity.

Conversion Parity Price Definition - Investopedia Conversion Parity Price = Value of Convertible Security / Conversion Ratio For example, suppose an investor had a convertible bond with a current market price of $1,000 that could be converted into...

How to Buy More than $10,000 in I Bonds Annually I Bonds are issued by the federal government and carry a zero-coupon interest rate — plus, they are adjusted each year for inflation. The variable return will sit at 9.62% through October 2022. Unlike other U.S. securities, these bonds are sold at face value — meaning if you purchase a $100 bond, the price will be $100.

GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond - Insider The payment of the coupon will take place 2.0 times per biannual on the 01.04.. At the current price of 96.29 USD this equals a annual yield of 5.25%. The General Motors Co.-Bond was issued on the ...

Why the stock market keeps falling: The end of zero interest rates Just maybe, ZIRP (zero interest rate policy) is no more. That, at least, is now priced into the bond market, with one-year Treasurys now yielding more than 4%, the highest since 2007. By the numbers: On Sept. 9, for example, futures markets priced in less than 1% odds that the Fed's target rate will be above 4.5% by February.

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... A $5000 bond is worth 200 times what a $25 bond is worth; a $100 bond is worth 4 times what a $25 bond is worth. If you have a $80 electronic bond at TreasuryDirect, it is worth 3.2 $25 bonds. The $25 bond value is always rounded to the nearest penny. Thus, a $5000 bond must always have a value that is a multiple of $2.00.

Japan Government Bonds - Yields Curve Japan Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

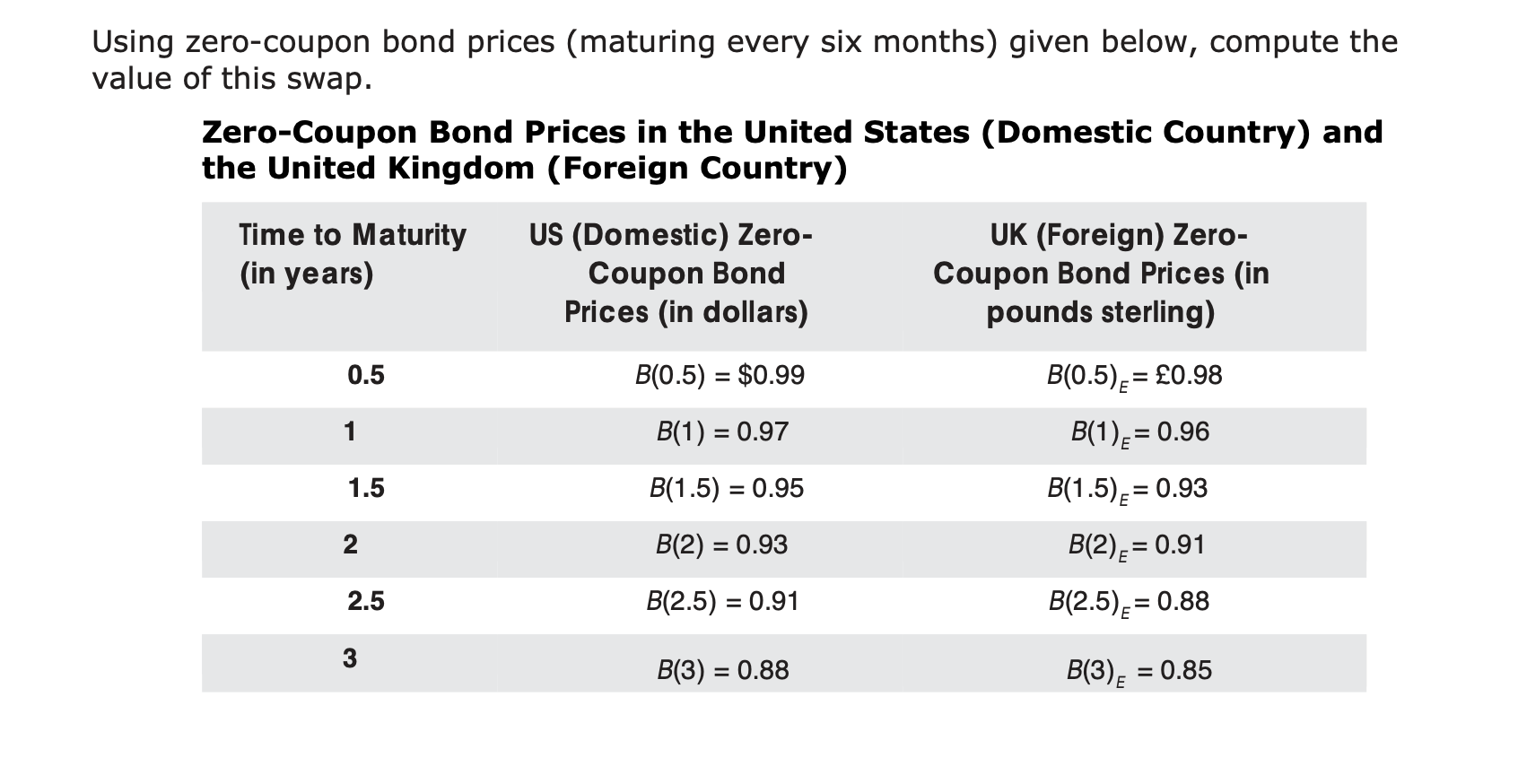

Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is an exchange of cash flows in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap, but where the stream of...

United Kingdom Government Bonds - Yields Curve United Kingdom Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

How to Invest in Bonds - The Motley Fool With the Federal Reserve aggressively hiking interest rates in 2022, yields have gone up, which means that bond prices have generally gone down. Not all bonds pay interest. Some bonds, known as...

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/08135541/Zero-Coupon-Bond-Calculator.jpg)

Post a Comment for "38 bond price zero coupon"