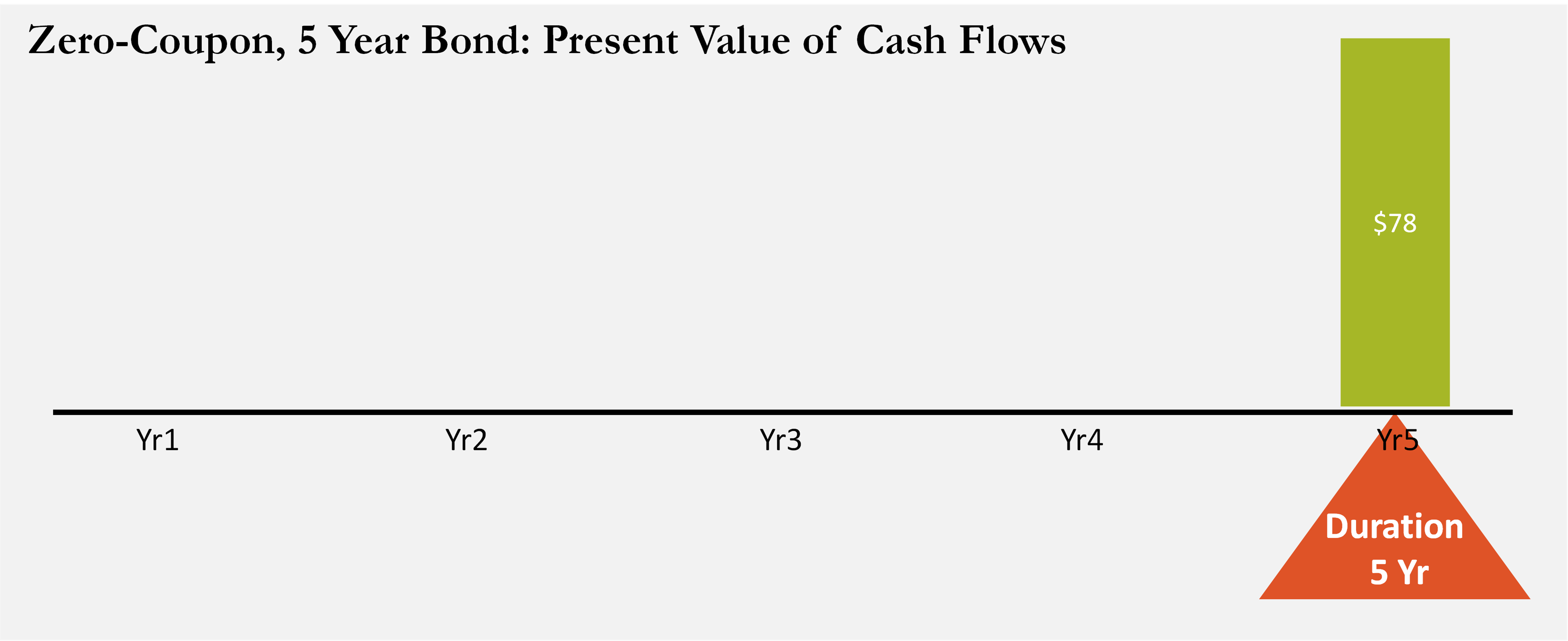

45 what is the duration of a zero coupon bond

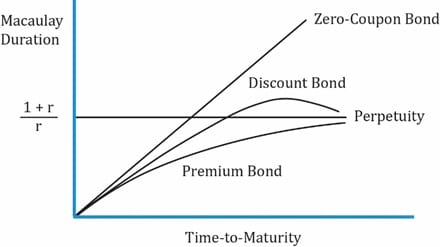

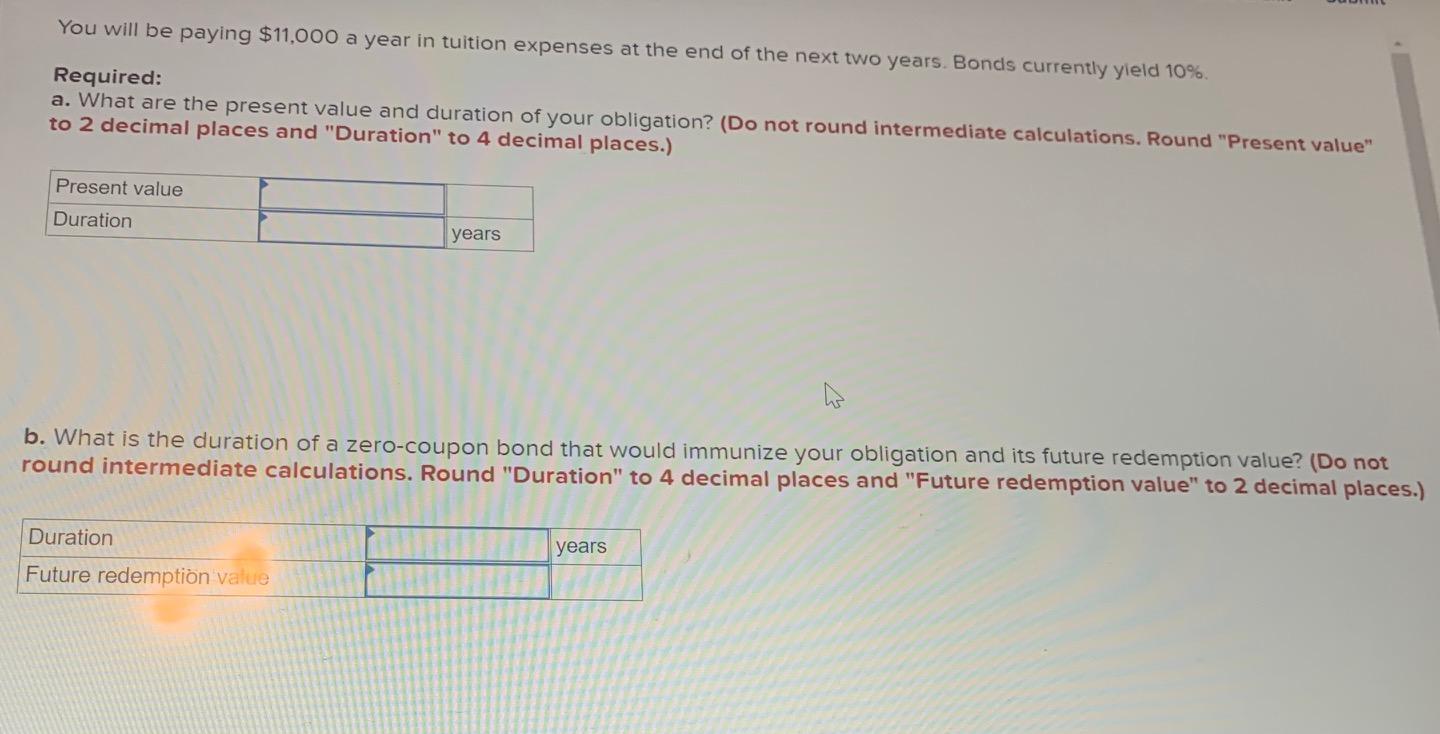

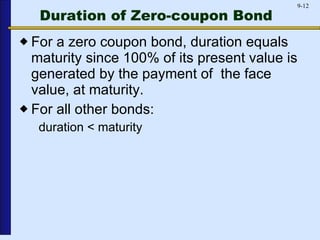

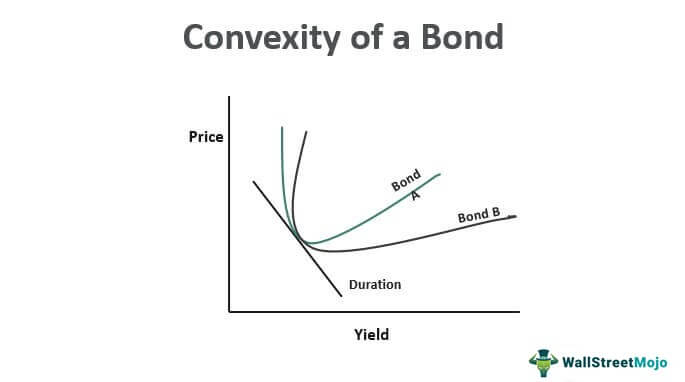

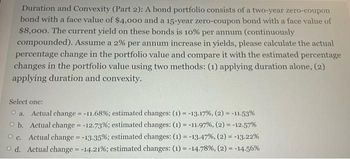

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!)

Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

What is the duration of a zero coupon bond

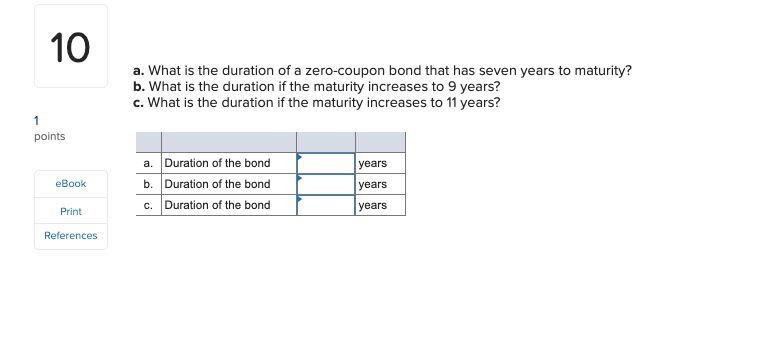

Solved 37. What is the duration of a zero-coupon bond that | Chegg.com What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years? (니 \ ( L G \) 3-7) This problem has been solved! See the answer Show transcribed image text Expert Answer 100% (1 rating) Zero coupon bond are not eligible for duration calculation as … How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond. What is the duration of a zero-coupon bond that has eight years ... - Quora Answer (1 of 5): Macaulay duration is the weighted average time to cash flow, weighted by the present value of the cash flow. A zero-coupon bond only has one cash flow, so the Macaulay duration is equal to the time to cash flow, 8 years and 10 years in your question. The modified duration is the...

What is the duration of a zero coupon bond. What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. When the bond reaches maturity, its investors receive its par (or face ... Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... What Is Bond Duration? Definition, Formula & Examples In the world of bonds, "duration" does not mean timeframe ...

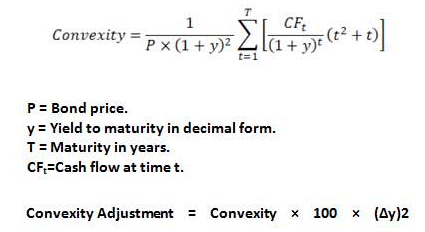

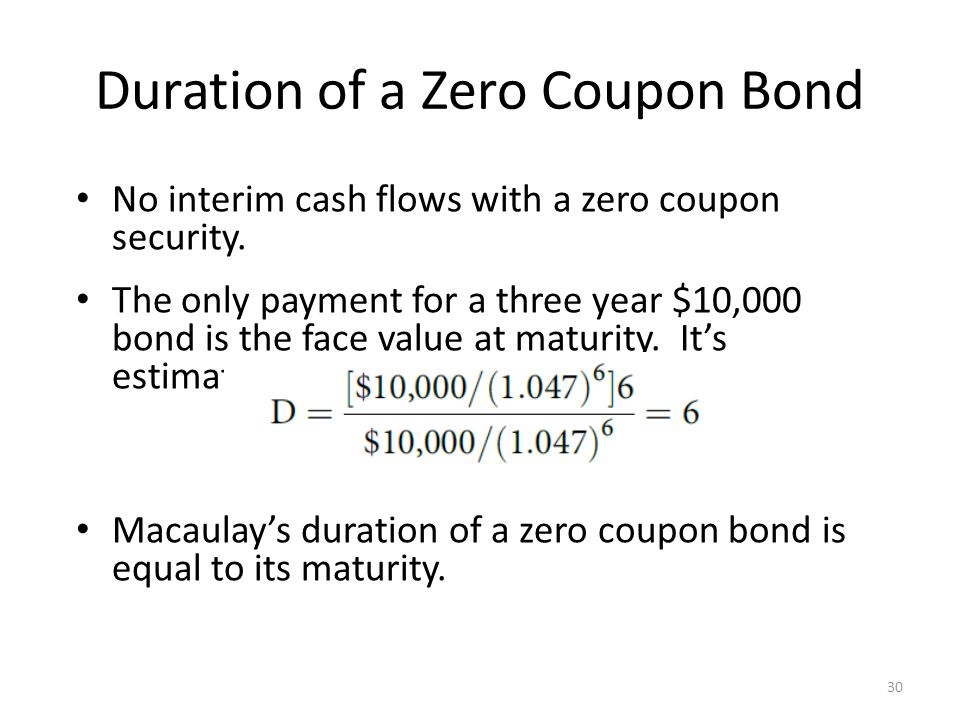

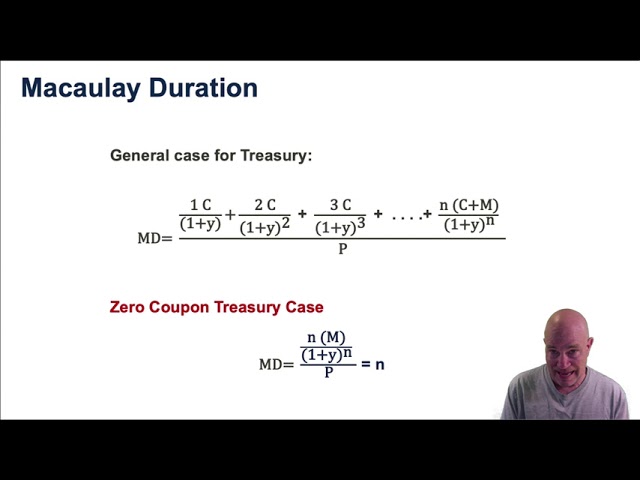

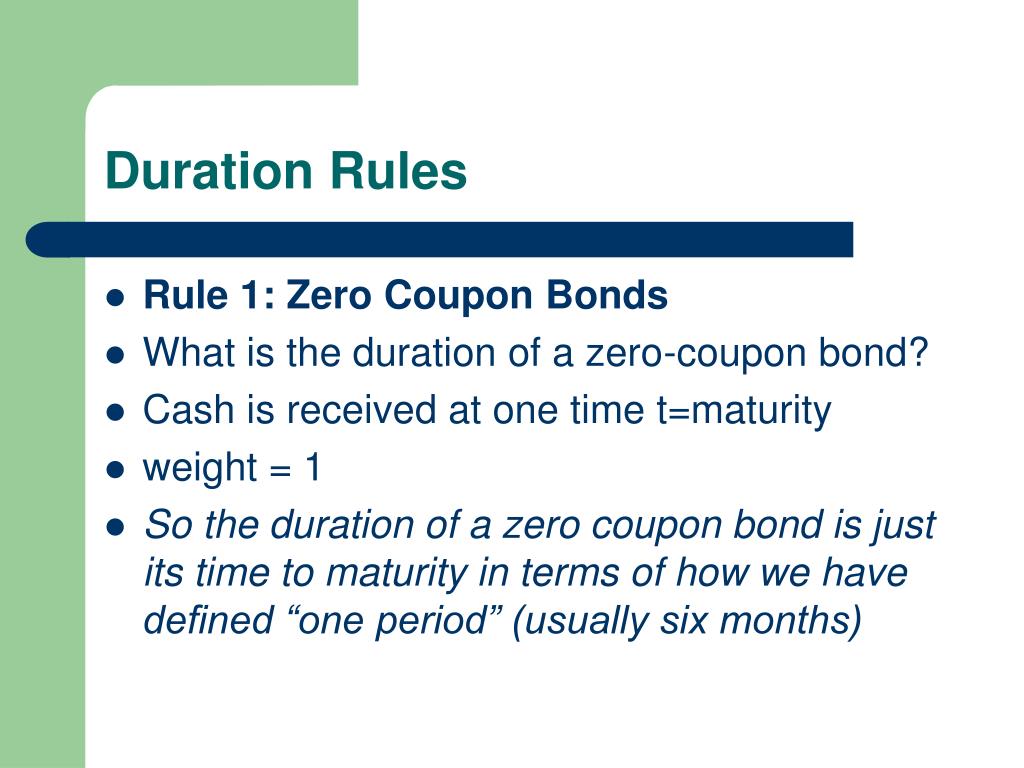

risk management - Calculate duration of zero coupon bond - Quantitative ... Let F ( x) = A × e a x be a function of x. Then, the first derivative of F with respect to x, denoted by d F d x, is given by Derivative of F (x) with respect to x = d F d x = A × a × e a x = a × F ( x) The book shows (duration of zero coupon bond): D z, T = − 1 P z ( t, T) [ d P z ( t, T) d r] = − 1 P z ( t, T) × [ − ( T − t) × P z ( t, T)] Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially... Dollar Duration - Overview, Bond Risks, and Formulas The formula for calculating dollar duration is: Dollar Duration = DUR x (∆ i/1+ i) x P Alternatively, if the change in the value of the bond and the yield is known, another formula can be used: DV01 = - (ΔBV/10000 * Δy) Where: ΔBV = Change in the value of a bond Δy = Change in yield Factor of Inaccuracy in Dollar Duration The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

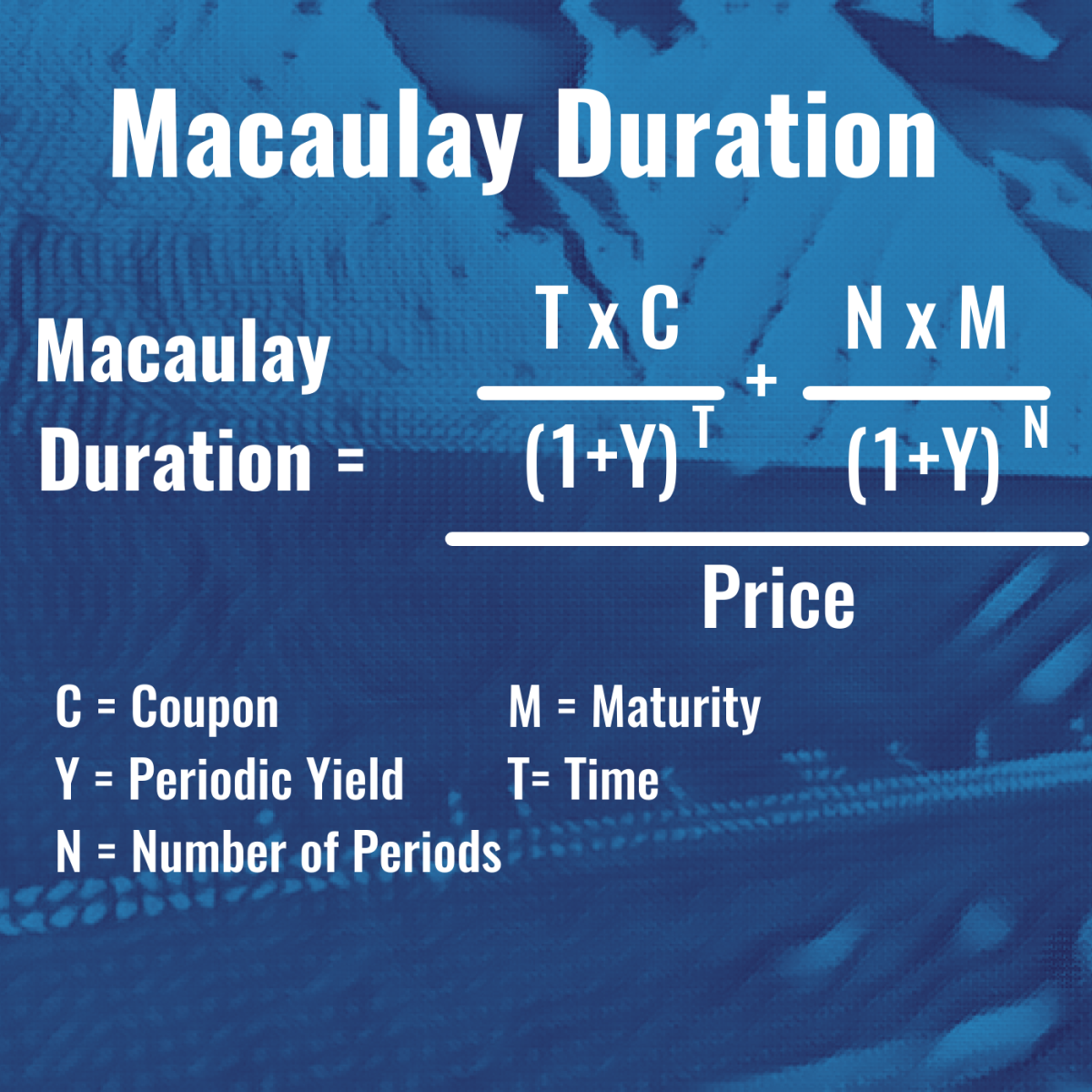

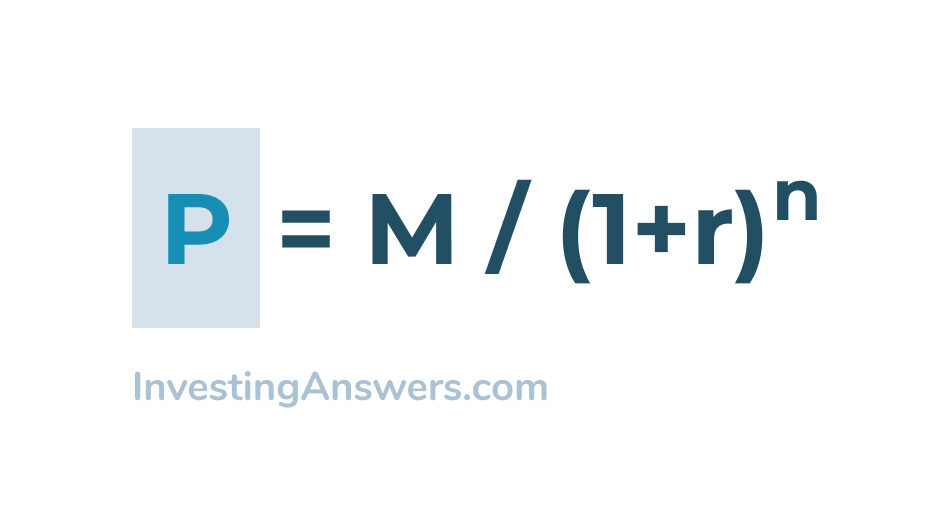

Zero Coupon Bond Calculator - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon What is the duration of a bond? and How to Calculate It? The formula used to calculate the modified duration of a bond is as below: Modified duration = Macaulay duration / (1 + Yield To Maturity of the bond) The results obtained from this model are in the form of a percentage. As mentioned above, the higher this percentage is, the higher the inverse relationship between the price of a bond and the ... Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero-coupon bond - Wikipedia A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years. For some Canadian bonds, the maturity may be over 90 years. [citation needed]

The One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds.

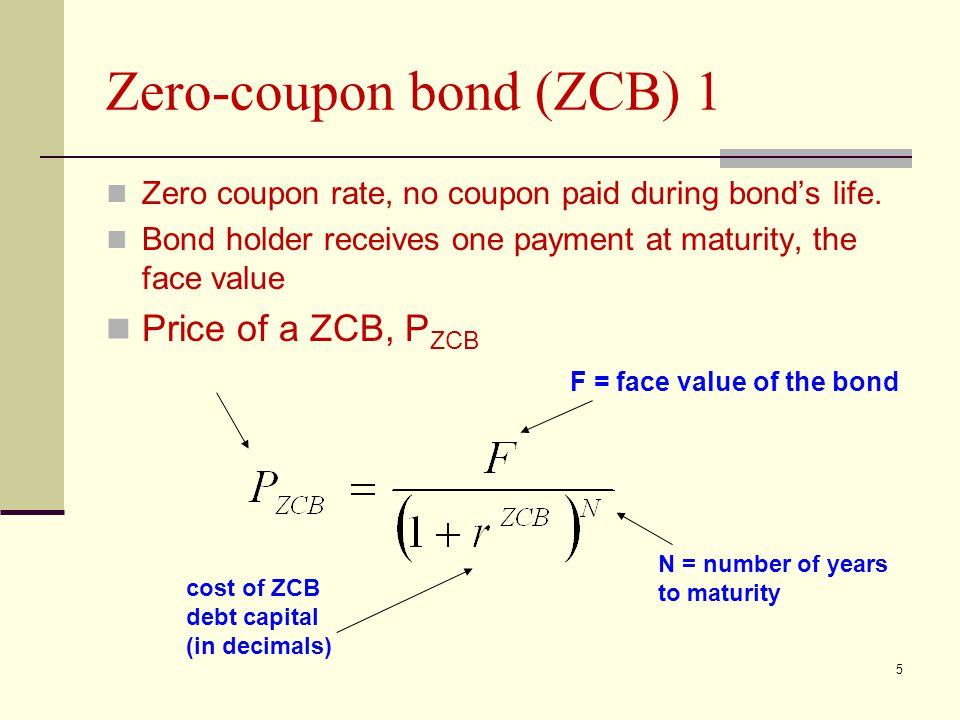

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

Solved a. What is the duration of a zero-coupon bond that - Chegg a. What is the duration of a zero-coupon bond that has six years to maturity? Duration of the bond= _____ years. b. What is the duration if the maturity increases to 7 years?

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Essentially, when you buy a zero, you're getting the sum total of all the interest payments upfront, rolled into that initial discounted price. For example, a zero-coupon bond with a face value of...

For zero coupon bonds? Explained by FAQ Blog What is a zero-coupon bond Mcq? A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return.

Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep In our illustrative scenario, let's say that you're considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions Face Value (FV) = $1,000 Number of Years to Maturity = 10 Years Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0%

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This can be found by table, by formula, or by use of an Excel spreadsheet 1. Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900. present value = $20,000 × $0.8900. present value = $17,800.

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

What is the duration of a zero-coupon bond that has eight years ... - Quora Answer (1 of 5): Macaulay duration is the weighted average time to cash flow, weighted by the present value of the cash flow. A zero-coupon bond only has one cash flow, so the Macaulay duration is equal to the time to cash flow, 8 years and 10 years in your question. The modified duration is the...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond.

Solved 37. What is the duration of a zero-coupon bond that | Chegg.com What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years? (니 \ ( L G \) 3-7) This problem has been solved! See the answer Show transcribed image text Expert Answer 100% (1 rating) Zero coupon bond are not eligible for duration calculation as …

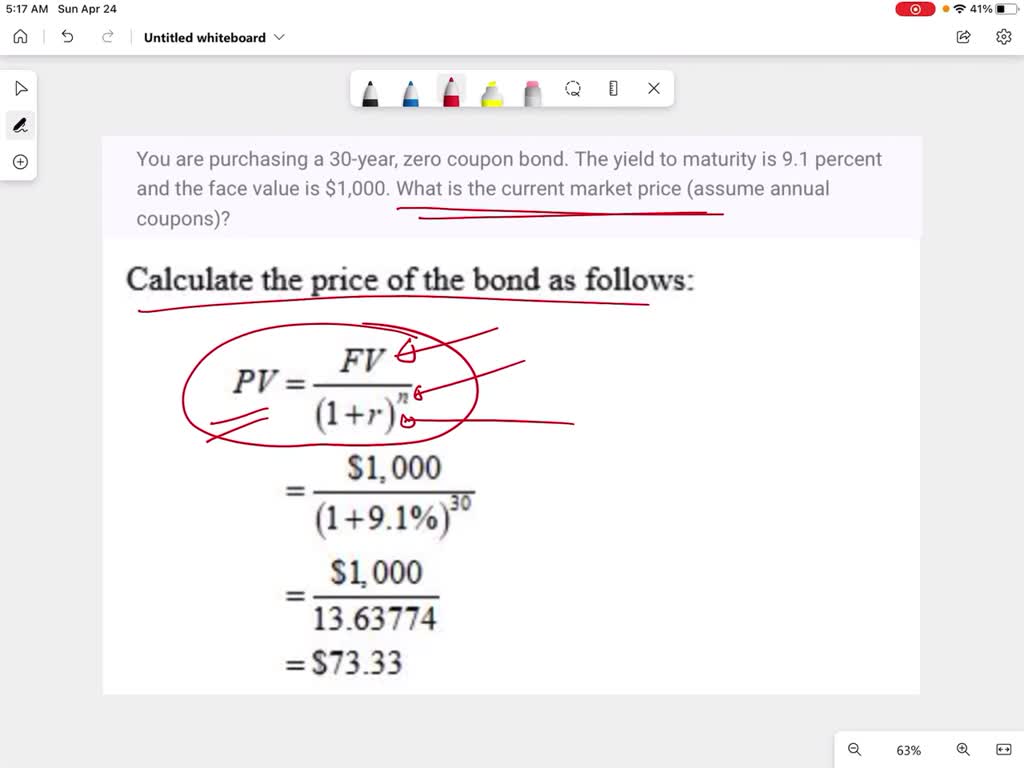

you are purchasing a 30 year zero coupon bond the yield to maturity is 91 percent and the face value is 1000 what is the current market price assume annual coupons 34097

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-02-a79edb63b9264dc9a76ee587240a27ea.jpg)

Post a Comment for "45 what is the duration of a zero coupon bond"