42 zero coupon bond value calculator

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Zero-Coupon Bonds: Characteristics and Calculation U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000.

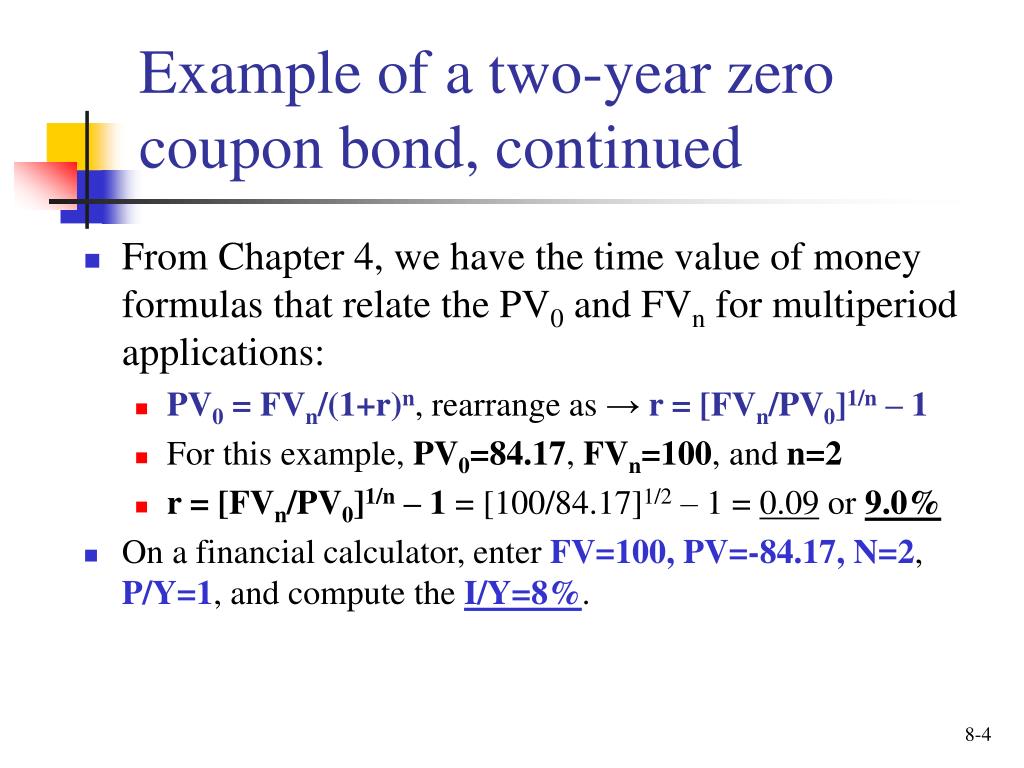

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Zero coupon bond value calculator

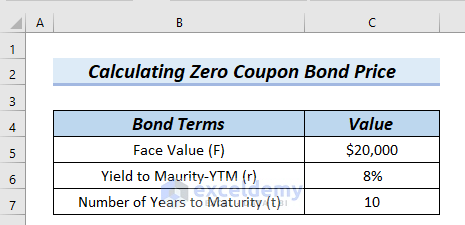

Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. Zero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero Coupon Bond Value Formula - Crunch Numbers How to calculate the price of a zero-coupon bond? Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM. Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is ...

Zero coupon bond value calculator. Zero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. Zero Coupon Bond Calculator - Calculator App The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does not pay interest but trades at a discount and renders a ... Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Zero Coupon Bond Value Calculator » Platformus The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Zero Coupon Bond Value Calculator Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero Coupon Bond Value Calculator - Florida Reviews Co 20 year, 7% coupon bond D. 20-year, 9% coupon bond E. Cannot tell from the information given. 7-year, 0% coupon bond B. 7-year, 12% coupon bond C. 7 year, 14% coupon bond D. 7-year, 10% coupon bond E. Just remember, the higher the duration, the more sensitive the bond is to interest rate changes, and thus, the more prone it is to interest rate ... Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value.

Zero Coupon Bond Value Calculator - buyupside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 . Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present Value ...

Zero Coupon Bond Value Calculator - stockmarketcalculators.com Use this zero coupon bond value calculator to compute the face value of the bond at maturity. A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The amount paid at maturity is called the face value.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate.

Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05

Zero Coupon Bond Value Formula - Crunch Numbers How to calculate the price of a zero-coupon bond? Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM. Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is ...

Zero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10.

Post a Comment for "42 zero coupon bond value calculator"